AARON CARTER’S ESTATE & INHERITANCE

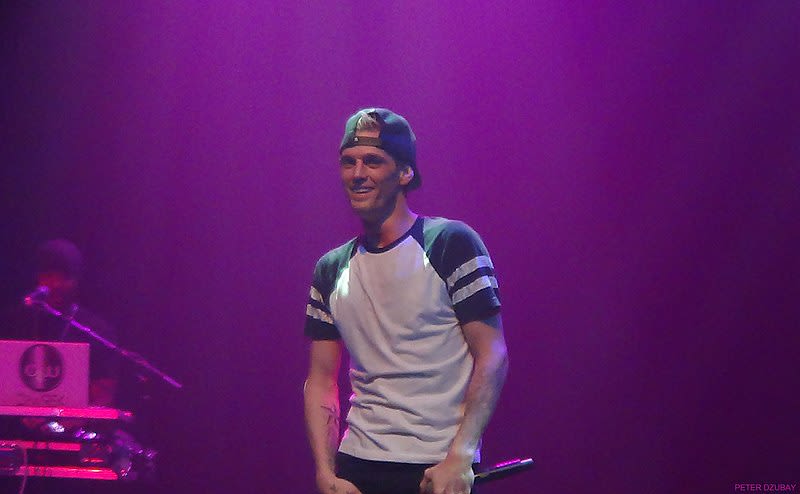

Former child pop star and musician Aaron Carter died in November 2022 at the young age of 34. Aaron’s passing was one of the more tragic celebrity deaths of 2022. It’s also one of the messiest from a legal perspective. The late singer died unmarried and without a will, raising questions about the value of his estate, what will become of his remaining fortune, and who will provide care for his young child.

Aaron’s one-year-old son stands to legally inherit everything. And other family members have reportedly said they don’t plan to dispute his inheritance. But there is still the issue of who will manage his son’s money until he comes of age. Aaron didn’t have an estate plan so the court will decide what happens to his fortune.

Aaron Carter’s History with Money

Aaron Carter never achieved the stardom of his older brother Nick Carter, a Backstreet Boy. But, he was a highly successful performer in his own right. He opened for the Backstreet Boys at age nine and shortly thereafter landed a record deal. Between his music and acting careers, Aaron made over $200 million before turning eighteen.

But if you keep up with pop culture news, you know that Aaron declared bankruptcy in 2013. So where did all his money go? Well, growing up as a celebrity was not without difficulties. After a decade of almost nonstop touring, Aaron learned that he owed around $4 million in taxes. The kicker is, he only had $2 million in the bank. After declaring bankruptcy, his net worth was just over $8,000 with over $2.2 million in liabilities.

If only he had a trusted tax advisor on his side…

Aaron blamed his parents for mishandling his money and leaving him in a hole he could never recover from. According to him, his parents violated California’s Coogan Law. Designed to protect child performers, this law required Robert and Jane Carter to set aside 15% of Aaron’s money in a Blocked Coogan Trust Account until he came of age. Similar laws have been passed in New York, Illinois, Kansas, Louisiana, Nevada, New Mexico, North Carolina, Pennsylvania, and Tennessee.

Aaron also accused his mother of taking funds out of his bank account. He publicly feuded with his family until the day he died.

A bright spot in his life was the birth of his son Prince in 2021. But at the time of his death, Aaron and ex-fiancée Melanie Martin didn’t have custody of Prince. This was allegedly due to concerns about drug use and domestic violence. Melanie was granted custody of Prince in December, after Aaron’s death.

California’s Intestate and Succession Law

Aaron died intestate, meaning without a will. Therefore, his estate is subject to California succession law.

Because Aaron was unmarried, his entire estate will pass to his son Prince. Jane Carter has said that the family is on board with this and wants Prince to be taken care of financially. If Aaron didn’t have a son, his parents would have been next in line to inherit his estate.

TMZ estimated the value of Aaron’s estate to be $550,000.

Unresolved Issues in Aaron Carter’s Estate – Prince’s Inheritance

While Aaron’s family has indicated there won’t be any inheritance drama, it’s uncertain who will manage Prince’s money while he’s still a minor. In California, a minor can’t inherit property in their name until they reach the age of 18.

California law provides for what is known as a guardianship of the estate. This is to be set up when a child inherits more than $5,000 and their benefactor has not set up a trust to hold the funds. Typically, the court appoints the surviving parent to be the guardian of the child’s estate.

Several family members could potentially serve as Prince’s Guardian of the Estate:

- Angel Carter, Aaron’s twin sister. Angel filed a petition in December 2022 to become the administrator of Aaron’s estate. As estate administrator, Angel would serve as Aaron’s legal representative. She would be in charge of closing his accounts, paying his debts, and distributing assets to Prince.

- Jane Carter, Aaron’s mother. However, given the allegations that she mismanaged her own son’s money, she isn’t likely to be chosen.

- Melanie, Prince’s Mother. A court determined that she was fit to take custody in December, so, they may decide that she is fit to look after his inheritance as well. However, she will have to petition the court to become guardian of Prince’s estate.

Additional family members could also submit petitions. The court would then decide which one is best qualified for the role.

The court could order one of the following:

- A guardianship must be created and Prince’s money must be turned over to the guardian.

- The money must be invested with the County Treasurer.

- The money must be deposited in a blocked account or a single premium deferred annuity, with withdrawal permitted only by court order.

- All or part of the money must be turned over to a custodian under the California Uniform Transfers to Minors Act. This act allows a court-appointed custodian to manage the minor’s account without a guardian or trustee until the minor turns 18.

A guardian of Prince’s estate would be required to carefully manage his money and property. They would need to make smart investments, collect and inventory estate accounts and property, maintain accurate financial records, and regularly file financial accountings with the court. A court order is required to make many types of guardianship financial transactions. The guardianship can be removed and transferred when the court deems it is in the child’s best interest.

Take Control of the Future by Hiring an Estate Planning Attorney

Those close to Aaron Carter say he would have wanted Prince to have everything. Fortunately, it appears that his final wishes coincide with state law—but that is not always the case. Not having an estate plan can increase the odds of a family fighting over money, property, and the care of surviving children.

About two-thirds of Americans don’t have an estate plan, leaving the fate of their money and property up to state law. In some cases, the decision of who will care for their children will also be left to the court. A simple will can address many of these problems.

Our experienced estate planning attorneys in Dublin, OH can help you make your final wishes known. We can also help with issues related to guardianship and probate litigation. To set up an appointment, please call us at 614-389-9711.